What to Know About Freight Insurance

Why Freight Insurance is so Important

Cargo claims are inevitable, which is why freight insurance is so important. Studies estimate that as much as 30% of losses during transit are unavoidable and relying on the Freight Carriers legal liability may not be adequate. This is why insurance should be considered for all freight shipments.

Carriers are not obligated to pay for losses that are beyond their control, which includes circumstances like an Act of God (weather), war, improper packaging, quarantine restrictions, or attempts to save life or property at sea.

When your company does not insure cargo, it faces a significant risk of financial loss because damage, loss or freight charges may not be recoverable. Additionally, carriers limit their liability by tariff and resolution of claims can be time-consuming and costly.

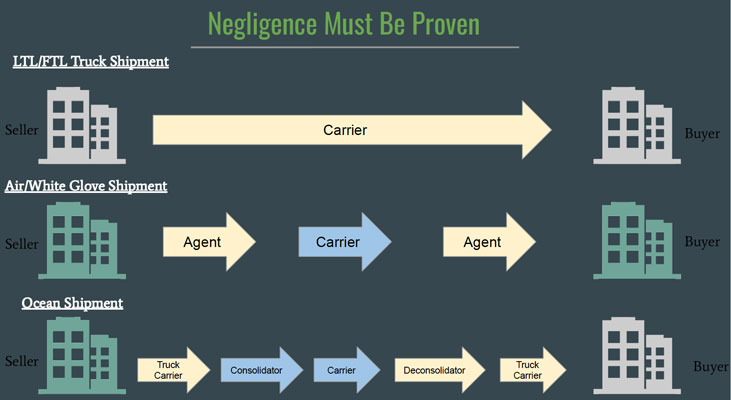

And the transit hazards freight must navigate grow daily; including everything from loading, unloading, and handling to highway or railway transit. There’s also water damage, fire, contamination, and theft to fear. Consequentially, it is your responsibility as the claimant to prove the carriers’ negligence caused the loss or damage.

Insuring shipments for transit is needed because liability must be proven by the claimant. This means that it’s not up to the carrier to prove they didn’t cause damage, and simply being damaged in transit is not proof of a carrier’s negligence. Carrier’s limit their liability using a range of tactics. With insurance to protect your financial interests shipment protection is “covered”..

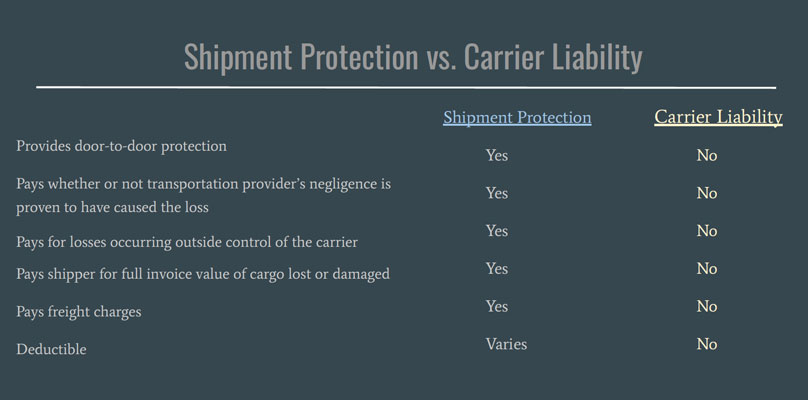

As a simple cost-effective way to provide “all-risk” protection, cargo insurance or Shippers Protection pays for the retail value of the goods and the freight charges. It provides coverage for all modes of transit and there is no deductible for insured value less than $10,000 – with a tiered deductible after that.

Shipment protection is an all-risk coverage provided by an insurance company to protect your freight through transit without reliance on the carrier’s legal liability. It’s important to note the differences between shipment protection and the legal liability of the carrier (before they limit it)..

Special Insurance Conditions

All-Risk cargo insurance protection covers new merchandise that has been properly packaged and is not usually susceptible to loss. It also covers used merchandise that is properly packaged with special insuring conditions. Common conditions include:

- Electronics including TV, monitors, laptops, tablets must be professionally packaged. Will require evidence of pre-shipment condition via photos and/or a receipt from a professional packaging company.

- Fragile goods including marble, granite, ceramic, tile and pottery must be professionally packaged. Will require evidence of pre-shipment condition via photos and/or a receipt from a professional packaging company.

- Original/Fine Art must be accompanied by an invoice or appraisal within the last 90 days of shipping. Cannot be valued over $20,000 each

- Used commodities must be packaged per NMFC guidelines, pre-shipment pictures strongly encouraged for all values and are mandatory for values over $2,500.

- Rebuilt/reconditioned engines must be crated

- Personal effects/household goods must be professionally packaged and have a value itemized inventory completed prior to shipping. Will not cover physical damages unless it can be proven, tht the damage happened due to an insured peril; this condition covers only full losses.

- Full list of conditions available by request.

There are some items that are excluded from coverage completely. These commonly include:

- Automobiles/motorcycles

- Bulk cargo

- Currency, coins, COD payments, checks, stamps, deeds, gift cards, gold, silver, money orders

- Cotton

- Flowers, live plants

- Grandfather clocks

- Live animals

- Models (cars, airplanes, architectural)

- Fine Art (valued over $20,000 per piece)

- Neon items

- Pharmaceuticals, drugs

- Plate/flat glass/windows

- All boats

- Full list of excluded items available upon request

Freight Insurance Deductibles

Any settlement of a claim will be paid less the deductible amount per the declaration of insurance.

LTL/Air/Ocean shipments are subject to the following deductibles:

- $0 deductible for shipments when the total insured value if up to $10,000 USD

- $500 deductible for shipments when the total insured value is from $10,000.01 USD up to $25,000 USD

- $1,000 deductible for shipments when the total insured value is from $25,000.01 USD up to $100,000 USD

- 2% of total insured value deductible for shipments when the total insured value is greater than $100,000 USD

Truckload shipments are subject to the following deductibles:

- $1,000 deductible for shipments when the total insured value is up to $100,000 USD

- 2% of total insured value deductible for shipments when the total insured value is greater than $100,000 USD

Collecting on Freight Insurance

When collecting on insurance claims, there are some critical points to consider. Concealed damage claims require that written notice to carrier and insurance company be made within 5 days of delivery to preserve your ability to file a claim. Proper packaging required per NMFC regulations is the packaging standard. Documentation of packaging with a pre-shipment photo when insured value >$2,500 is highly recommended, if not required.

Additionally, Insurance Claims must be filed within 60 days for noted-damage claims and 15 days of delivery for concealed damage claims and the claimant must mitigate if possible by repair, salvage, or scrap.

If you have questions, or would like to see an illustration of shippers risk cost in terms of your operations claims loss history; we’d like to help! Contact Customodal today!